Have you ever opened a Salesforce Account and seen “Pending Payment” even though the customer paid yesterday in Stripe? Many businesses still rely on manual processes to copy data between Salesforce and Stripe. A sales rep closes an opportunity, Finance opens Stripe to create a customer record, and someone later updates the payment status in Salesforce. It’s slow, repetitive, and risky.

During this delay, cash flow slows down, reports go out of sync, and customers wait for confirmation emails that should have been automatic. This gap between the CRM and the payment gateway affects accounting accuracy and customer experience.

Insight:

McKinsey notes that automating accounts payable and receivable processes can cut processing time by roughly 50%, helping teams move payments faster and with fewer manual steps. In general, integrating systems and becoming a "Data Pioneer" leads to a strong competitive advantage: an IBM study from 2024-2025 found that organizations that effectively use their data are 60% more likely to outperform their competitors in revenue growth and 51% more likely to outperform them in profitability.

That problem disappears once the CRM and payment processor share the same data. That’s why many organizations choose Salesforce Stripe integration, a direct link that keeps customer, transaction, and subscription data synchronized. With this setup, teams can track Stripe payments in Salesforce automatically, ensuring everyone works from one accurate source of truth.

Let’s see how that works in practice.

Understanding How Salesforce and Stripe Interact

Salesforce is the world’s leading customer relationship management platform, used to manage sales, service, and customer interactions in one place. It helps teams track leads, close opportunities, and analyze performance across every stage of the customer lifecycle.

Stripe, on the other hand, is a global payment processor built for online transactions, subscriptions, and billing automation. It supports multiple currencies, cards, and digital wallets while handling compliance and security in the background.

Stripe website

When these two systems work together, payment and customer data flow in sync. Sales teams see who has paid, finance teams manage invoices without exporting data, and every department works from the same real-time information.

In Search of Stripe Salesforce Connector

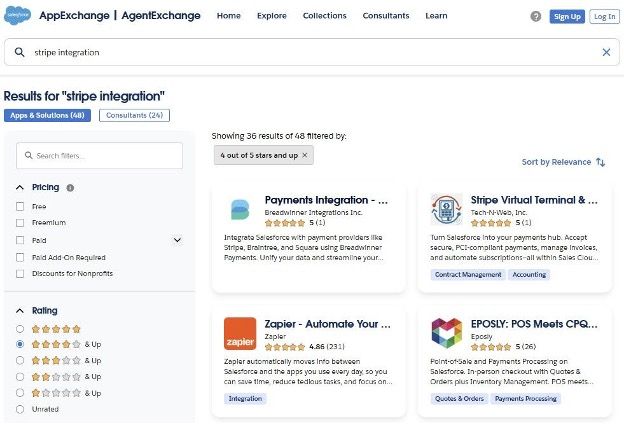

For this review, the focus is on solutions that can be installed and used immediately within Salesforce, without long development cycles or external integrations. Enterprise tools like MuleSoft or Boomi are capable of connecting Stripe and Salesforce, but they often involve complex setup, custom mapping, and higher maintenance costs. Many teams prefer a direct AppExchange app that brings payment data into Salesforce automatically and requires no additional middleware.

We started our research on AppExchange, an official Salesforce marketplace, with such keywords as “Stripe integration”. Among available options on AppExchange, Breadwinner Payments stood out for being both Salesforce-certified and purpose-built for payment processing. It connects Salesforce with Stripe, Square, and Braintree, giving users a complete view of payment activity while preserving security and control inside the CRM.

Stripe integration options on AppExchange

How Breadwinner Payments Works in Salesforce

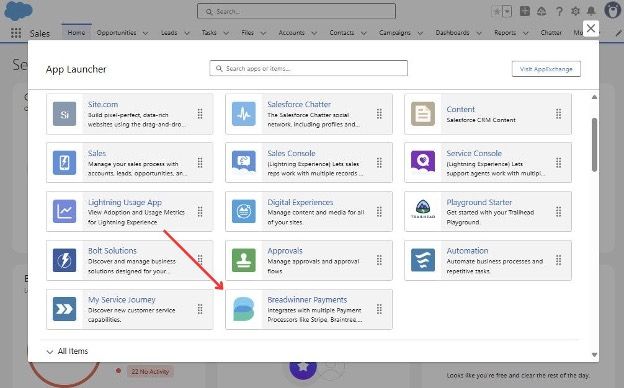

Breadwinner provides a Salesforce-native application that brings live payment data from Stripe directly into Salesforce records. After installation, it appears as a regular Salesforce app.

Breadwinner Payments app in the Salesforce Org

Once connected, the integration mirrors the structure of your connected Stripe account with all major Stripe objects inside Salesforce, including:

- Customers

- Transactions and refunds

- Payment methods (cards and bank accounts)

- Subscriptions and invoices

- Products, prices, and coupons

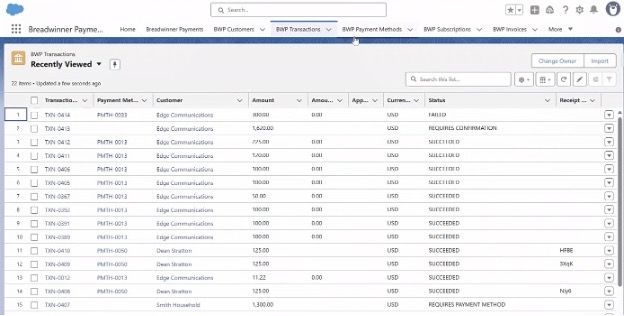

Imported transactions from Stripe inside Salesforce

Working with Stripe Data Within Salesforce

From any Account or Contact record, users can view related lists showing current transactions and subscription details.

- Finance teams can issue refunds, create invoices, or set up recurring payments without switching between systems.

- Sales reps can check payment status before renewing a deal, and customer service can verify failed charges while handling support cases.

- Customer service can verify failed or overdue invoices without leaving Salesforce.

- Administrators control setup from the Breadwinner Payments tab, where they can connect processors, map customers, and assign permission sets.

That’s the practical value of a Stripe connector for Salesforce: everyone works with complete and up-to-date financial information.

How Data Flows Between Salesforce and Stripe

Breadwinner’s solution synchronizes payment data in both directions. When a charge or refund happens in Stripe, it appears instantly in Salesforce. When a sales or service rep creates a payment in Salesforce, it updates in Stripe right away.

Here’s a simple overview of how it works:

| Direction | Action | Example |

|---|---|---|

| Stripe → Salesforce | Sync customer, payment, and subscription data | A new Stripe charge appears on the related Account record |

| Salesforce → Stripe | Create or refund transactions, subscriptions, or invoices | A service rep refunds a payment directly in Salesforce |

| Bidirectional integration between both systems | The data updates automatically in both directions, between Stripe and Salesforce | Any new or changed payment record in one system appears in the other within minutes |

Breadwinner Payments combines Stripe’s financial accuracy with Salesforce’s reporting and automation features, giving teams a single, consistent place to manage all payment activity.

This connection makes Salesforce payments Stripe a daily routine rather than an isolated task handled only by the finance department.

How to Connect Salesforce to Stripe: Step-by-Step Setup

Integrating Stripe with Salesforce through Breadwinner Payments usually takes less than an hour. Installation is handled entirely inside Salesforce, making it straightforward even for small teams.

Before You Begin

Before installing the connector, confirm that you have the correct access levels in both systems:

- Salesforce requires the Enterprise Edition or higher, with administrator permissions to install packages, update page layouts, and assign user access.

- For Stripe, use an active account with Administrator or Developer rights and decide whether to start in Test or Live Mode.

It is also helpful to plan how Stripe customers will map to Salesforce records, either Accounts or Contacts, and verify that your organization’s currency settings are consistent across both systems.

Step 1. Install from AppExchange

Open the AppExchange listing and install the package for Admins Only. This ensures permissions are properly restricted at first. A free trial is available through the same listing, allowing teams to explore the integration before full deployment.

Breadwinner Payments on AppExchange

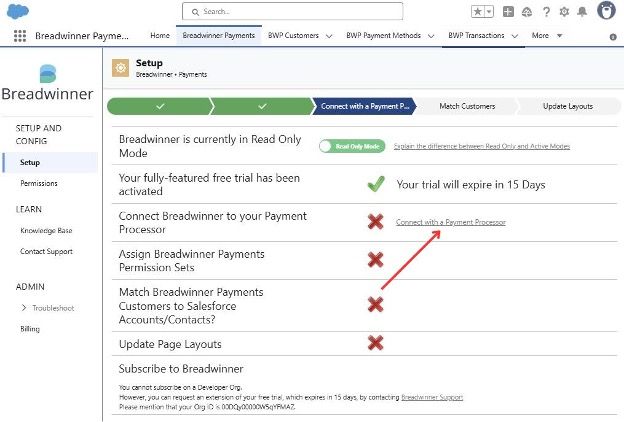

Step 2. Authenticate with Stripe

In the setup tab, click “Connect with a Payment Processor”.

Starting the authentication process

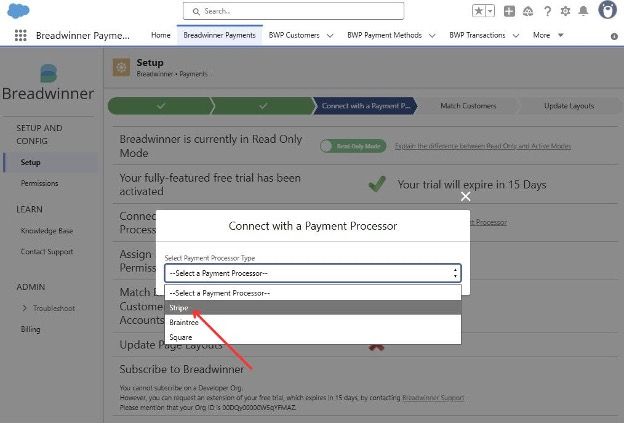

Select Stripe, and choose between Test or Live Mode. Sign in with your Stripe Admin or Developer credentials to approve access.

Selecting Stripe as a Payment Processor

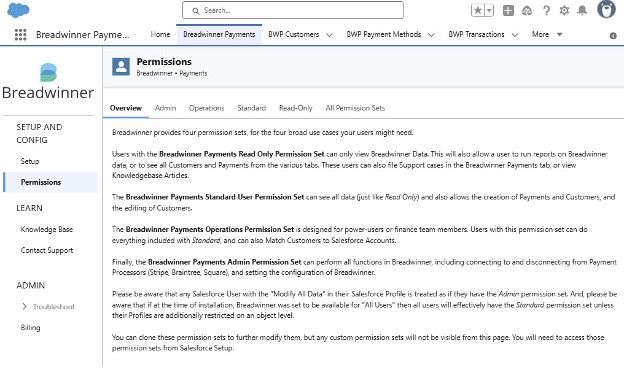

Step 3. Assign Permission Sets

Before users can access payment data, assign the provided Breadwinner Payments Permission Sets to the appropriate Salesforce profiles. This step controls visibility and editing rights for financial information, keeping sensitive data secure while ensuring authorized users can view or manage transactions.

Step 4. Match Customers

Map Stripe Customers to Salesforce Accounts or Contacts. Other objects, such as payments, invoices, and subscriptions, sync automatically.

Step 5. Update Page Layouts

Add the new related lists (Payments, Subscriptions, Invoices) to your chosen Salesforce objects.

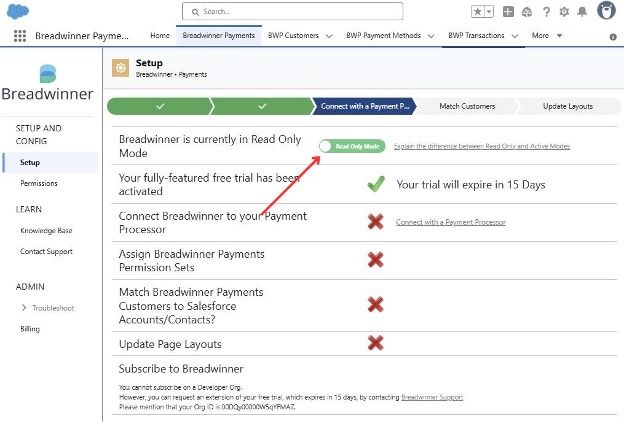

Step 6. Choose Read-Only or Active Mode

Read-Only Mode lets users view payment data safely. Active Mode allows authorized users to create transactions and synchronize them with Stripe.

Step 7. Test Before Going Live

Use a Salesforce Sandbox and Stripe Test Mode to verify data flow both ways.

This process defines a complete Stripe payment gateway integration in Salesforce that is fast, secure, and reliable.

Beyond Setup: Automation and Customization Options

After installation, the integration can be extended with automation tools that suit different skill levels.

- For regular users: Guided Wizard enables staff to create payments, invoices, and subscriptions step by step while reviewing details before submission.

- For advanced configurations: Custom Guided Wizard lets admins extend Breadwinner Payments to custom Salesforce objects such as Orders or Projects. By adding a custom button with URL parameters, users can launch the same step-by-step payment or invoice creation flow directly from those records.

- For developers: Global API allows automated payment workflows through Apex or Flows. Teams can build triggers to issue invoices or send renewal reminders based on Stripe events.

These options turn Breadwinner into a flexible Stripe universal connector for Salesforce, adaptable to both small organizations and complex enterprise environments.

Security and Compliance You Can Rely On

Financial data security is one of the top concerns in any integration project. Breadwinner Payments was built with this in mind.

- SOC 2 Type II compliance and regular security audits.

- PCI alignment, ensuring no sensitive card data is stored in Salesforce.

- Tokenization: Stripe encrypts card information and returns secure tokens to Salesforce.

- Permission Sets: Admins decide who can view or edit payment data, keeping access limited to necessary roles.

Together, these controls create a dependable Stripe universal connector Salesforce users can trust.

What Teams Gain from a Connected Payment System

Integrating Stripe and Salesforce changes how departments collaborate around revenue. Consistent payment data also supports forecasting and audit requirements.

| Team | Key Gain | Example |

|---|---|---|

| Sales | Faster quote-to-cash | Create subscriptions or charge cards right after closing a deal |

| Finance | Reliable coordination | Payment data automatically matched to opportunities |

| Customer Success | Real-time visibility | See failed or overdue payments before renewal calls |

When every payment and refund is recorded on the corresponding Account or Opportunity, finance can produce accurate revenue reports directly in Salesforce without exporting to spreadsheets.

This unified view shortens audit cycles and helps leadership trust the financial dashboards they review each month. Teams save time, avoid duplication, and maintain cleaner records. That’s why many organizations adopt this model for Stripe payments Salesforce management.

Real-World Example: LPI Membership Automation

The Learning and Performance Institute (LPI) wanted to modernize its membership payments.

Before integration, LPI staff manually exported data from Salesforce to Stripe each week.

By using Breadwinner Payments, they connected both systems in one project lasting about three months. Results:

- 100% of Stripe transactions synced successfully into Salesforce.

- Every member set up recurring payments through Stripe Billing.

- Six hours of administrative time are saved weekly.

- Faster onboarding for new members.

- Today, sales and finance teams share one live dashboard in Salesforce showing all active and overdue subscriptions.

LPI reports smoother renewals and better forecasting accuracy, an example of effective Salesforce Stripe integrations applied in the real world.

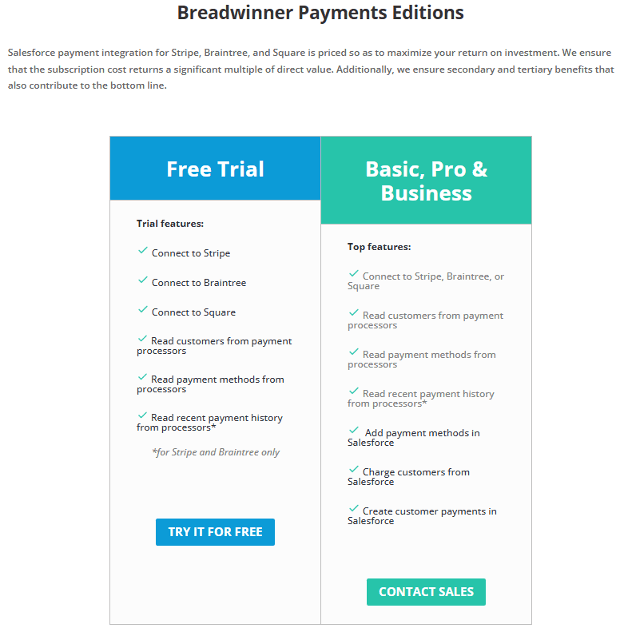

Licensing and Support Information

Breadwinner Payments is available through different subscription editions listed on the website, including a free trial. Each edition provides access to the core Salesforce integration with payment processors such as Stripe, Braintree, and Square.

User support is provided for all active subscriptions. During the setup stage, teams can also receive technical guidance to ensure the integration is configured correctly. The installation follows Salesforce’s standard managed-package process and does not require external development.

Breadwinner Payments pricing

For teams already using Salesforce CPQ or recurring billing features, Stripe integration complements those processes by handling payment and invoicing directly from the CRM. This makes it a straightforward Stripe billing Salesforce CPQ integration alternative for organizations that want automation without building custom connectors.

Final Takeaway: From Delays to Real-Time Revenue

Disconnected systems slow down revenue and create unnecessary manual work. Integrating Salesforce and Stripe aligns everyone around the same goal: getting paid on time with accurate data.

Beyond technical benefits, this type of integration improves how departments communicate. Sales, finance, and customer success all work from the same information, reducing duplicate effort and misunderstandings about payment status:

- Reports become more reliable,

- Forecasts are more accurate, and

- Customers receive confirmations faster.

Using a dedicated native solution like Breadwinner Payments, you can integrate Stripe with Salesforce in under an hour, synchronize both systems, and manage payments, refunds, and subscriptions without leaving the CRM, which makes it the best choice in terms of time-to-value. Go and get your free trial today to see how simple Salesforce payment automation can be.